In the world of finance, understanding the fundamental principles of accounting is akin to having a sturdy foundation for a towering skyscraper. These accounting concepts serve as the bedrock upon which financial statements are built, offering insights into a company’s financial health and performance.

In this blog post, we’ll unravel the seven key accounting concepts, demystifying their significance and providing real-world examples to illustrate their application.

Table Of Content

1. Why Accounting Concepts are Crucial

2. 7 Concepts For Financial Clarity

2.1 Entity Concept

2.2 Going Concern Concept

2.3 Money Measurement Concept

2.4 Cost Concept

2.5 Dual Aspect Concept

2.6 Accounting Period Concept

2.7 Conservatism Concept

3. Conclusion

Why Accounting Concepts are Crucial

Before we delve into the specifics, it’s essential to grasp why accounting concepts hold such paramount importance.

They serve as a universal language for businesses, investors, and stakeholders alike.

Without a standardized set of principles, financial information would be akin to a labyrinth, making it impossible to compare and evaluate the performance of different entities.

These concepts ensure transparency, accuracy, and consistency in financial reporting, fostering trust and confidence in the world of commerce.

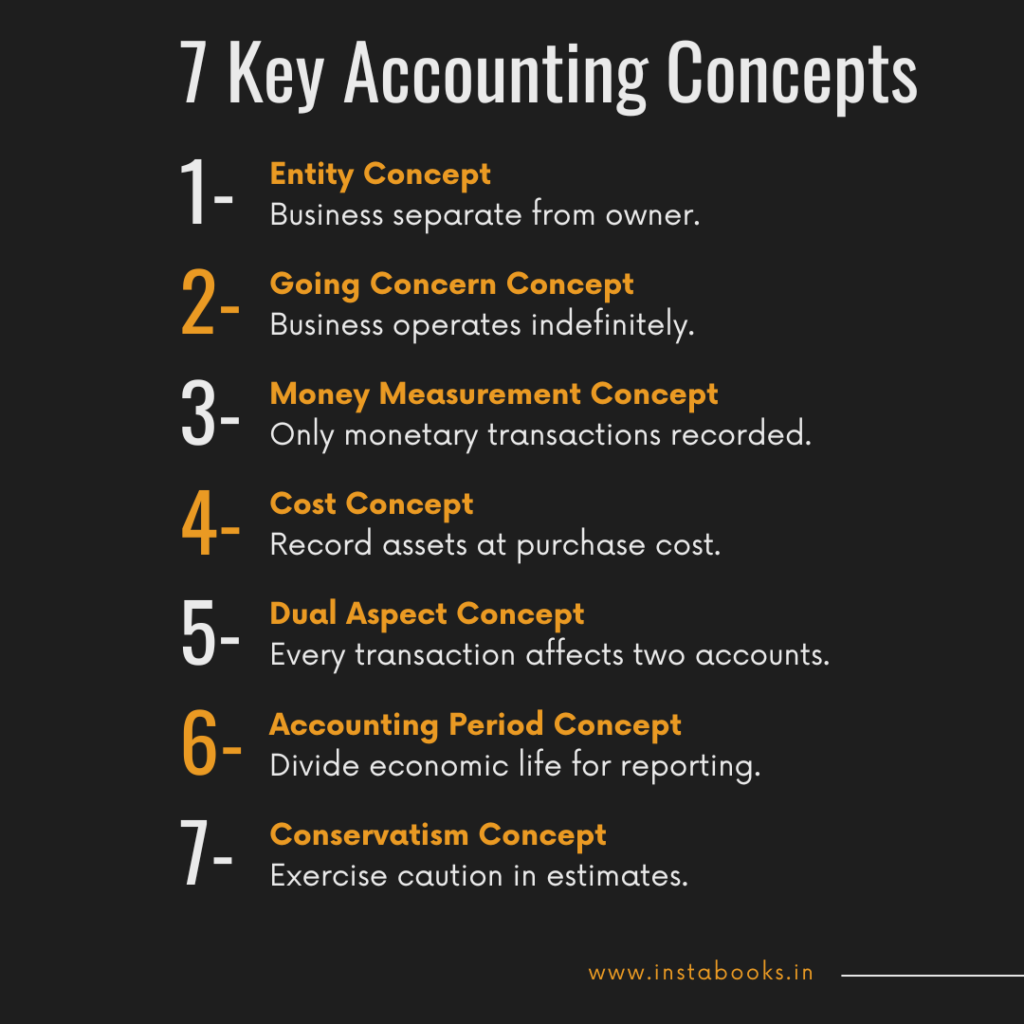

7 Concepts For Financial Clarity

Entity Concept

The Entity Concept stands as a cornerstone, emphasizing the separation between the business and its owners.

This principle asserts that the financial affairs of the business must be accounted for distinctively from the personal affairs of its proprietors.

For instance, imagine a sole proprietorship where the owner invests $50,000 into the business. According to the Entity Concept, this $50,000 is considered a liability owed by the business to the owner, separate from the business’s assets and liabilities.

Going Concern Concept

The Going Concern Concept assumes that a business will continue its operations indefinitely unless there is compelling evidence to the contrary.

This concept enables businesses to prepare financial statements under the assumption that they will continue their operations for the foreseeable future.

For example, if a retail store generates profits year after year, the Going Concern Concept allows the business to present financial statements assuming it will continue operating in the upcoming fiscal period.

Recommended: Find out the best accounting softwares and various types of accounting software.

Money Measurement Concept

In the realm of accounting, not everything that matters can be precisely measured in monetary terms. The Money Measurement Concept restricts the recognition of items in financial statements to those that can be expressed in monetary units.

For instance, consider the dedication and expertise of employees – invaluable to a company’s success. However, as per the Money Measurement Concept, these attributes cannot be quantified in financial statements.

Cost Concept

The Cost Concept, also known as the Historical Cost Concept, dictates that assets should be recorded at their original purchase cost. This principle provides a reliable and objective basis for valuing assets.

For example, if a company purchases machinery for $10,000, this cost is recorded as the initial value of the asset, regardless of its current market value.

Dual Aspect Concept

The Dual Aspect Concept asserts that every financial transaction has two aspects: a debit and a credit.

This concept forms the basis of double-entry bookkeeping, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced.

For instance, if a business acquires supplies for $500, it records an increase in assets (supplies) and a corresponding decrease in cash, maintaining the equilibrium of the accounting equation.

Accounting Period Concept

The Accounting Period Concept divides the economic life of a business into distinct, manageable periods for reporting purposes.

This concept facilitates the assessment of a company’s performance over specific intervals, such as monthly, quarterly, or annually.

For example, a company may choose to prepare financial statements on a quarterly basis to provide stakeholders with regular updates on its financial performance.

Conservatism Concept

The Conservatism Concept advises accountants to exercise caution when estimating future uncertainties.

It suggests that in situations where there is ambiguity, a conservative approach should be adopted, recognizing potential losses rather than speculative gains.

For instance, if a company holds an inventory of goods whose market value has declined below their cost, the Conservatism Concept advises recording an impairment loss to reflect the lower value.

Wrapping Up

Mastering these seven accounting concepts lays the groundwork for sound financial management. They serve as guiding principles, ensuring accuracy, consistency, and transparency in financial reporting.

By understanding and applying these concepts, businesses can navigate the complex world of finance with confidence, making informed decisions that drive success and growth.

So, embrace these concepts as your allies on the path to financial clarity and prosperity!